IRS Form W7 in PDF

- 12 October 2023

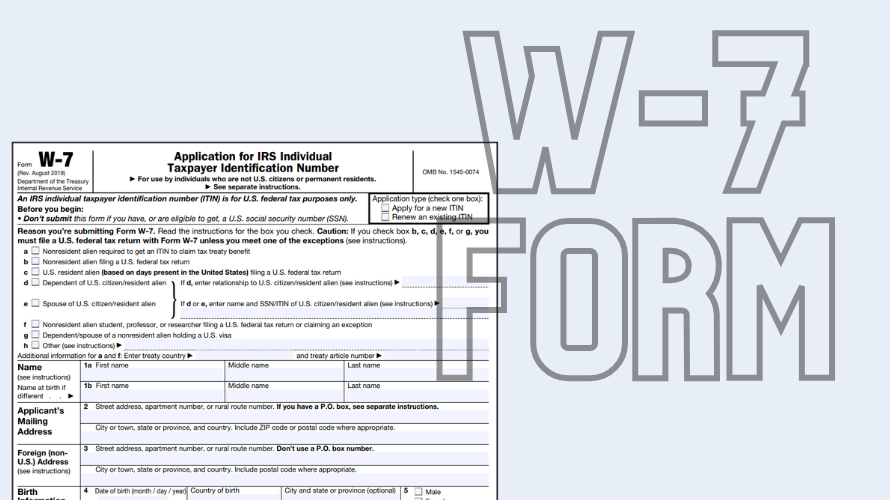

Every year, millions engage in tax season preparedness armed with various tax forms. The IRS W-7 form in PDF is crucial and has a specific purpose within the tax system. It's a document designed for taxpayers or eligible dependents who are not eligible for a Social Security Number (SSN). This form aids them in applying for an Individual Taxpayer Identification Number (ITIN), enabling them to file their taxes.

Features of the Fillable W-7 Form in PDF

Filing out physical forms can be a hassle, and that's why the digital age has come to your rescue. To streamline this process, you can use the W7 form in fillable PDF format, which has myriad benefits. Compared to hard copies, using fillable PDFs eliminates the risk of lost or misplaced forms, making your record-keeping tremendously easy. They also give you the advantage of editing the information, reducing the chances of errors. Moreover, digital forms are environmentally friendly and efficient for large-scale business operations.

Fillable Form W-7: Possible Difficulties

Filing the IRS Form W7 in PDF format online offers numerous benefits, such as convenience and speed. However, this efficient process has its share of challenges, which prospective filers should know.

Technical glitches represent a significant concern when opting for online filing. The online system may encounter occasional hiccups, such as server outages or software errors, which can disrupt the submission process. These technical challenges might delay completing the form, impacting your application's timeliness.

User errors are another potential obstacle. While the IRS strives to provide clear and concise instructions, the tax code's complexities can still lead to misunderstandings. First-time users, in particular, might find themselves grappling with unfamiliar terminology and intricacies.

Mastering the W-7 PDF Form

For those who aim to successfully complete the online W-7 form for 2023 in PDF format, here are some of the rules to follow.

- First and foremost, take the time to thoroughly read and absorb the provided instructions before immersing yourself in the form-filling process.

- Second, emphasize the importance of accuracy throughout the entire application. Providing incorrect or incomplete information can result in significant delays or, in the worst-case scenario, a rejection of your ITIN application.

- Lastly, before submitting your Form W-7, make it a routine practice to double-check the form for any potential discrepancies. This final review is a critical step in detecting any overlooked errors, misspelled names, or inconsistencies that could hinder the smooth processing of your application.

Wrapping It Up

Taxation can seem complex, especially when dealing with forms like the W7 application in PDF. However, you can navigate this process smoothly with proper understanding and careful attention to detail. Remember, adopting the digital approach of utilizing fillable PDFs simplifies the procedure and saves time and resources.