Handling the W-7 Form for Print Quickly & Easily

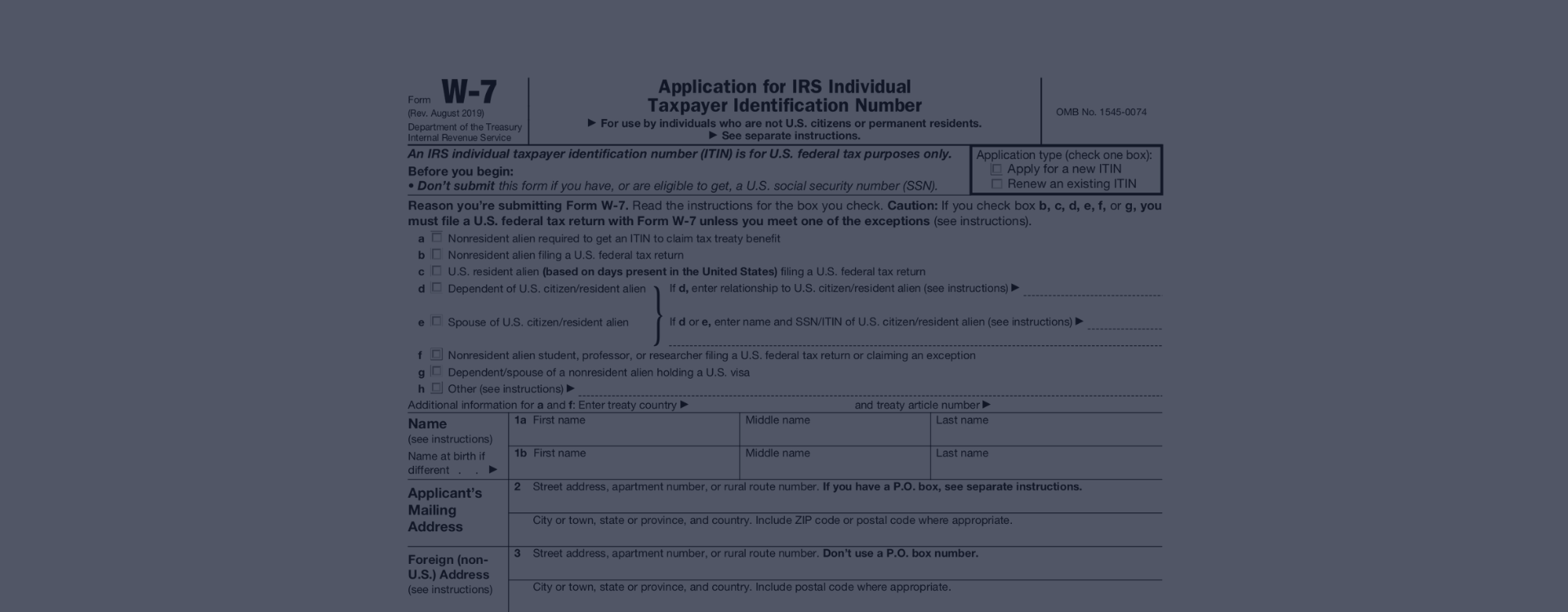

Form W-7, also known as the Application for IRS Individual Taxpayer Identification Number, is required when a U.S. non-resident or resident alien who does not qualify for a Social Security Number decides to file a U.S. federal tax return. The primary purpose of IRS Form W-7: ITIN Application is to ensure accurate federal income tax returns by assigning an individual taxpayer identification number to those ineligible for a Social Security Number.

Our Website Advantages

For anyone challenged by the IRS Form W-7 process, w7-form-printable.com provides invaluable resources. We offer an IRS Form W7 for download, making it convenient for anyone, anywhere, to access and utilize. Our website doesn't stop at just providing the form. It also includes comprehensive guidance on how to complete each section accurately. The instructions come in handy for those who find the IRS terminologies and rules complex. Additionally, examples are given to understand better how to input your details correctly. Providing the W7 form printable and free makes the task straightforward and accessible, simplifying what can be confusing for many.

The W-7 ITIN Application Form Purpose

Generally, the ITIN W-7 application form is required by the U.S. Internal Revenue Service (IRS) for individuals who don't have a Social Security Number but need to file their taxes. These individuals can be foreign nationals, nonresident aliens, or U.S. residents who do not qualify for an SSN.

One such individual, Maria Perez, a 35-year-old freelance graphic designer from Mexico City who recently moved to New York, is a prime example. Therefore, Maria is not a US citizen and does not have a Social Security Number, obligating her to adhere to the IRS W7 form instructions for 2023 when filing her taxes. She needs an ITIN to report her income and comply with U.S. tax laws despite not being eligible for an SSN.

Similarly, we have John Afua, a 28-year-old nonresident alien from Ghana studying medicine at Stanford University. On his part-time campus job, John earns an income requiring him to file a tax return. Here, too, comes the necessity to print the IRS W-7 form. As a nonresident alien who can’t apply for a Social Security Number, John must obtain an ITIN to fulfill his tax obligations. The W-7 application allows him to do so legally and correctly.

The W-7 Form in 2023: Primary Tasks

-

![Identification Purpose]() Identification PurposeThe W-7 copy is primarily used to apply for an ITIN, which is necessary for individuals sought by the U.S. tax law, either to file the annual return or make a specific claim on an income return but are not eligible for an SSN.

Identification PurposeThe W-7 copy is primarily used to apply for an ITIN, which is necessary for individuals sought by the U.S. tax law, either to file the annual return or make a specific claim on an income return but are not eligible for an SSN. -

![Tax Compliance]() Tax ComplianceBesides, the free printable W7 form makes fiscal compliance easier for non-resident aliens and their spouses or dependents, ensuring adequate deduction and payment of tax, as stipulated by U.S. tax laws.

Tax ComplianceBesides, the free printable W7 form makes fiscal compliance easier for non-resident aliens and their spouses or dependents, ensuring adequate deduction and payment of tax, as stipulated by U.S. tax laws. -

![Reporting Framework]() Reporting FrameworkThe application offers an organized system for reporting income, assets, and financial activities within a fiscal year. This aids in maintaining transparency and accuracy in financial reporting.

Reporting FrameworkThe application offers an organized system for reporting income, assets, and financial activities within a fiscal year. This aids in maintaining transparency and accuracy in financial reporting.

Free Printable W7 Form in PDF

Get FormForm W7 Filing Instructions

Filling out the W-7 form for print might appear daunting for first-timers, but a keen eye for detail will make the process seamless.

- First, ensure you provide the necessary information, which includes the legal name under the 'Name' box, precise birth details, and residence details.

- Remember to include your country of residence under the 'Country Subject to Revenue Laws' box.

- One common mistake to avoid is rushing through it. Commit your time, and do not fill it out in haste. Invest time perusing through it, ensuring you've captured every detail. On our platform, you can download the W7 form in PDF printable at no cost. You may print it out after filling in your particulars online, making the process easier and more time-efficient.

- To help you further, we also provide a detailed W7 form example to comprehensively guide you through the process. Stick to these tips, and you can avoid any possible errors.

Fill Out the W7 Form on Time

The good news is you're not supposed to print Form W-7 and file it by a certain deadline. This form is filed when a taxpayer or dependent needs an identification number but doesn't have, and isn't eligible to get, a social security number. But, if you're applying for an ITIN to meet your tax filing obligations, it's crucial to submit your W-7 copy well before the tax filing deadline, which is typically April 15th.

Get FormIRS Form W-7 & Related Penalties

When dealing with any tax documentation, it's always essential to be accurate and timely. You can get a sample of the W7 form filled out ahead of time for reference. Be warned, though, that providing erroneous or doctored information is subject to penalties. According to the Internal Revenue Service, falsifying an application may be construed as tax fraud. Penalties include imprisonment and fines, the severity of which depends on the extent of the inaccuracies and falsehoods presented. Therefore, honesty and diligence should guide your actions when dealing with taxation matters.

ITIN Form W-7: Answering Your Questions

- Where can I find the IRS W-7 printable form in PDF?By following the link from our website, you can access the latest version of the application in a printable PDF version. Just click the "Get Form" button at the top of the screen. There are two options: obtain the blank template or complete it and print the filed one.

- What exactly is the IRS W-7 form printable?This is a document used by the Internal Revenue Service in the United States. It’s designed for individuals who are not eligible to obtain a Social Security Number (SSN) but require an identification number for federal tax purposes. The printable variant lets you fill it manually using a pen, should you prefer the traditional way of filling out documents.

- How often is a new printable W-7 form issued?Typically, the IRS does not change the W-7 form every year. However, you should keep an eye on the latest updates to ensure you use the current template and confirm its validity for the relevant tax year.

- What are the guidelines for filing a W7 form for 2023 printable?The process of filing the IRS ITIN application remains the same. That being said, reading the official instructions accompanying the form before filing is always advisable. These guidelines offer step-by-step assistance to ensure you fill out the application correctly.

- Can I get the W7 form to print for free?There are absolutely no costs associated with downloading and printing the W7 form from our website. The government provides these templates as a free resource to assist taxpayers in meeting their legal obligations. Perhaps there might be a fee if you want to get some extra options, like the advisor consultation.

More IRS Form W-7 Instructions

IRS Form W7 in PDF Every year, millions engage in tax season preparedness armed with various tax forms. The IRS W-7 form in PDF is crucial and has a specific purpose within the tax system. It's a document designed for taxpayers or eligible dependents who are not eligible for a Social Security Number (SSN). This form a...

IRS Form W7 in PDF Every year, millions engage in tax season preparedness armed with various tax forms. The IRS W-7 form in PDF is crucial and has a specific purpose within the tax system. It's a document designed for taxpayers or eligible dependents who are not eligible for a Social Security Number (SSN). This form a... - 12 October, 2023

- W-7 ITIN Form As a former lawyer and a current active participant in financial forums, I've advised and guided countless individuals through the intricacies of the United States tax system. If you are a non-resident alien who needs to file tax returns, you should be familiar with the IRS W-7 ITIN application samp...

- 11 October, 2023

- IRS Form W-7 in 2023 Whether you're filing your taxes for the first time or preparing for a comprehensive financial evaluation, understanding key IRS tax forms, like the U.S. Form W7, is incredibly important. In a few words, the U.S. Form W7 with instructions for 2023 is an official document issued by the U.S. Internal...

- 10 October, 2023

Please Note

This website (w7-form-printable.com) is an independent platform dedicated to providing information and resources specifically about the W-7 form, and it is not associated with the official creators, developers, or representatives of the form or its related services.